Climate funding in agriculture that considers women can improve environmental, social and economic outcomes

Photo: Hamish John Appleby / IWMI.

Photo: Hamish John Appleby / IWMI.

Key messages:

- Climate finance that responds to women’s needs can have significant positive impacts on climate and gender outcomes in the agriculture and land-use sectors.

- Although a variety of climate financing institutions are integrating gender and climate strategies, they need to better share approaches, benchmarks and lessons.

- A business case for gender-responsive finance is emerging, but clearer communication of evidence, definitions and approaches would instill greater confidence in private investors.

- Major climate finance actors should prioritize supporting intermediaries who have on-ground experience with the local contexts and associated gender and social dynamics.

Despite opportunities for significant impact, gender-responsive climate finance in agriculture remains underfunded

Women, particularly in developing countries, are disproportionately affected by the impacts of climate change. However, there is still much work to be done to leverage the unique position of women—in their households, communities and economies—to achieve positive climate and gender outcomes.

This effort is particularly relevant in the agriculture and land-use sector, which receives less than three percent of the world’s total annual climate finance despite contributing approximately one-quarter of annual greenhouse gas emissions. In emerging economies, where climate impacts are expected to be most severe, women make up nearly half of the agricultural workforce (45 percent) but receive less than 10 percent of available agricultural finance.

Gender-responsive financing—that is, actively accounting for the specific needs, vulnerabilities and strengths of women and men—offers approaches to ensure that climate finance in agriculture and land use is effectively and fairly deployed.

In a forthcoming working paper (Gender-Responsive Climate Finance in Agriculture & Land Use), the Climate Policy Initiative explores the current perceptions of the impact and business case for such financing; the major players and their current approaches; how climate finance in the sector can be made gender-responsive; and the key challenges and opportunities to address them.

Investment at the intersection of agriculture, climate and gender is slow growing, despite strong evidence for the potential positive impacts

The impact case for gender-responsive climate finance is broadly accepted, but many investors are still struggling to integrate both gender and climate into their agriculture-focused portfolios.

Meanwhile, investor confidence is limited by ongoing uncertainties about the business case, as well as confusion around the various definitions of gender-responsive finance and how to approach it. These uncertainties also make it difficult to determine how much of this finance is currently being deployed.

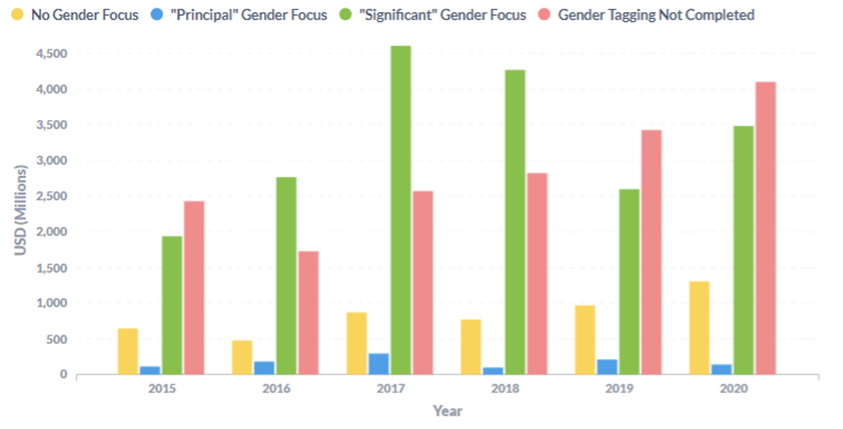

The OECD Development Assistance Committee has dedicated effort to capturing the level of gender focus of finance projects, but this remains unclear for a large proportion of projects due to incomplete labeling by investors.

OECD-reported climate finance in agriculture and land-use sectors showing gender focus.

Emerging investment strategies provide promising examples of how to address gender issues through climate and agriculture funding. Global capital providers can learn from organizations like the Green Climate Fund, FinDev Canada, and the International Fund for Agricultural Development to better integrate gender-responsive financing into their own programming.

Providers can achieve this by mainstreaming gender at the institutional level or by incorporating a climate lens into agricultural investment programs with an existing gender focus.

Better communication of positive returns, plus blended finance, can be used as evidence for the independent business case

Climate funds, governments and development finance institutions are at the forefront of gender-focused climate financing, even as their overall strategies on gender issues are still being integrated, clarified and improved.

Given ongoing concerns about the business case, they are essential to encourage private investment because they can deploy concessional capital, often within broader, blended finance structures.

Further analysis and better communication of the positive returns of gender-responsive approaches are needed to increase investor appetite. Recent publications provide initial evidence for the business case, but specialized research institutions like CGIAR, academia, and government agencies are well placed to further this work.

In the meantime, blended finance initiatives (such as the EcoEnterprises Fund) which leverage concessional finance to attract otherwise-hesitant commercial capital will continue to improve the business case by demonstrating their practical successes.

Women-led businesses, inclusive employment, and goods and services designed for women advance gender equality

Case studies revealed that, of the five indicators suggested by the global gender-focused initiative 2X Challenge, the following three appear to be the most common:

- #1: Entrepreneurship: promoting access to finance for agri-businesses led or owned by women or their collectives.

- #2: Employment: supporting organizations, including cooperatives, that employ women and actively promote gender-inclusive employment practices.

- #3: Consumption: promoting the design and uptake of goods or products that specifically benefit women, including financial ones (like insurance) and durable ones (such as agricultural equipment used by women).

Still, as mentioned previously, data collection and reporting are complicated by a lack of commonly agreed-upon approaches, benchmarks and even simple definitions about gender integration.

Efforts to address the challenges of defining gender-responsiveness and collecting data in rural areas are emerging. Initiatives like the 2X Challenge are helping to create comparable benchmarks for integrating gender into broader investments, although the full extent of adoption remains unclear.

Meanwhile, promising innovations in remote data collection, such as via mobile phone platforms, show promise in addressing the challenges of collecting data in rural areas.

Grants are the climate financing tool that most commonly consider women’s needs

From the data analysis conducted, grant financing appears to be the most common instrument used in the agriculture and land-use sectors to apply a gender focus.

While grant financing could be overrepresented due to lack of reporting from private investors, several other considerations may also help explain this finding:

- The private sector lacks confidence in the business case.

- Grant financing is commonly used to deploy on-ground training to address gender norms and biases, which can improve women’s access to land, education and financial services.

- Grants may be the only form of financing readily accessible to women: gender biases make it difficult for women to own land and accrue collateral, which in turn limits their access to debt financing.

Addressing systemic gender norms and biases that are particularly pervasive in rural agricultural communities is crucial. While grant-financed capacity building can help to challenge harmful biases and norms, financial innovations such as flexible loan terms or alternative collateral requirements can help overcome the barriers and challenges that these biases produce.

Impact investors, nonprofits and microfinance organizations deliver high-level capital for local-level solutions

Agribusinesses—particularly those that are women-led—are often too small to manage the high minimum-investment amounts that development finance institutions and national governments typically require.

It is essential to continue to support indirect financing provided by local-level actors. They play an important role in channeling and distributing finance through programming that is both more accessible and better informed by the local gender context.

Intermediary organizations deliver manageable financing in suitable currencies to women farmers and women-led agribusinesses, along with crucial capacity-building services tailored to the local context and gender norms.

--

Suggested citation: Thomas, B., Bagnera, E., & Pinko, N. 2023. Climate funding in agriculture that considers women can improve environmental, social and economic outcomes. Nairobi, Kenya: CGIAR GENDER Impact Platform.

References

Landscape of Climate Finance for Agriculture, Forestry, other Land Use and Fisheries: Preliminary Findings

Climate Policy Initiative. 2022. “Landscape of Climate Finance for Agriculture, Forestry, other Land Use and Fisheries:

Preliminary Findings.” https://www.climatepolicyinitiative.org/wp-content/uploads/2022/11/Landscape-of-Climate-Finance-for-Agriculture-Forestry-Other-Land-Uses-and-Fisheries.pdf

Ways to Gender-Smart Climate Finance: Sustainable agriculture, food and forestry

2X Collaborative. 2021. Ways to Gender-Smart Climate Finance: Sustainable agriculture, food and forestry. Brief.

Inclusion Pays: The Returns on Investing in Women in Agriculture

Root Capital. 2022. Inclusion Pays: The Returns on Investing in Women in Agriculture. Report. https://rootcapital.org/inclusion-pays/