Micro-Finance in the Dry Areas: a Case Study in Syria

Abstract

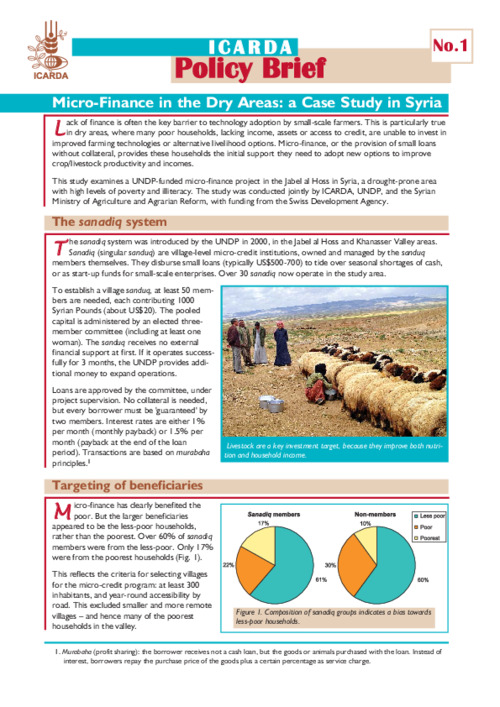

Lack of finance is often the key barrier to technology adoption by small-scale farmers. This is particularly true in dry areas, where many poor households, lacking income, assets or access to credit, are unable to invest in improved farming technologies or alternative livelihood options. Micro-finance, or the provision of small loans without collateral, provides these households the initial support they need to adopt new options to improve crop/livestock productivity and incomes.

This study examines a UNDP-funded micro-finance project in the Jabel al Hoss in Syria, a drought-prone area with high levels of poverty and illiteracy. The study was conducted jointly by ICARDA, UNDP, and the Syrian Ministry of Agriculture and Agrarian Reform, with funding from the Swiss Development Agency